“Our Earth is degenerate in these later days; bribery and corruption are common; children no longer obey their parents; every man wants to write a book, and the end of the world is evidently approaching.”

– Assyrian tablet, circa 2800 B.C.

These days, we are living through a period of high political tension. The national election is upon us. We are bombarded with daily pronouncements of how bad/good one election result will be for our country and the world. Many worry about the state of affairs and the future of our country. At times like these, we need to remember the quote above, recorded almost 5,000 years ago. Then, like now, people worried about the state of affairs.

The end of the world didn’t take place in 2800 B.C. Irrespective of the election outcome in November, it won’t end then, either. Worry about things you can change, not things you can’t. Be wise enough to recognize the difference. Take that to the bank.

Some Level of Disruption Is Good

While we all need to focus on issues that we can control (sorry, I can’t control election outcomes), we also need to understand from a historical perspective that countries and societies have done better when there is a certain amount of disruption occurring. Disruption leads to change, which leads to innovation.

That said, I know a high level of political instability is bad for an economy. But surprisingly, too much political stability can prove bad for an economy as well. Mancur Olson, who wrote “The Rise and Decline of Nations,”makes the case that institutional decay can arise over a period when democracies seek stability at any cost, which tends to lead to special interest groups gaining too much power. Empirical tests of the history of many different countries support this view.

Also, in a paper written for the Swedish Institute for European Policy Studies, it was shown that over decades in 30-plus European countries, a certain degree of “institutional instability” was additive to and fostered economic growth. The paper suggests the worst potential outcomes occurred in countries with stable but poorly run institutions. The authors suggest that flexibility is key to longer-term economic growth.

One of my favorite saws is “All of life is a careful seeking of balance.” Not too much instability nor stability should be sought. Just a few points to consider as we move into the depths of the political season.

Back to the Economy – Angels Flying Close to the Ground

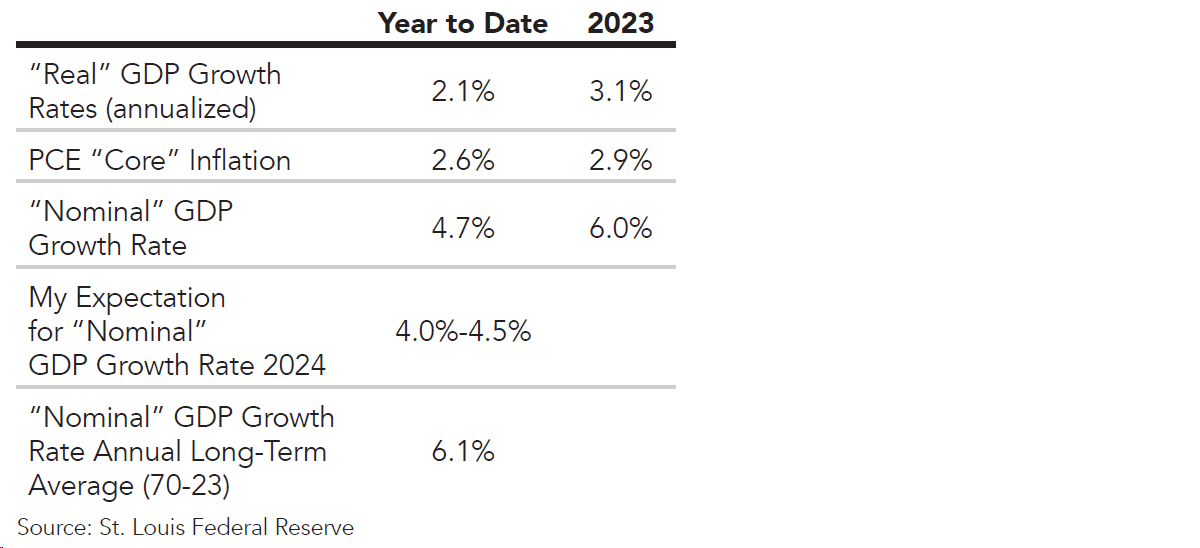

So far this year, my economic growth/inflation outlook has been playing out. The “Angels Flying Close to the Ground” theme embraces the view that overall gross domestic product growth rates will soften as compared to last year and inflation pressures should wane as well. I have been forecasting “real” GDP growth will come in at the 1.5% to 2.0% range for the year, and personal consumption expenditures “core” inflation should fall to the 2.5% range.

I have been suggesting that “nominal” GDP growth is expected to come in at around 4.5% this year as compared to 6.0% last year as real GDP growth slows and inflation continues to contract. While neither year-to-date data points (GDP growth and PCE inflation rates) are fully in the books yet, we can get a pretty good idea as to what they look like so far this year as compared to the same rates at the end of 2023.

What has been driving GDP growth rates down from last year’s experience? While still positive, the growth in consumer spending has slowed, driven by a softening labor market (unemployment is now 4.1% versus 3.6% this time last year). Data from the San Francisco Federal Reserve suggests consumers’ excess savings balances that were built during and shortly after the pandemic are gone. Also, following a significant upward surge in credit card utilization, growth in consumers’ use of revolving credit has slowed back to historical norms, according to the St. Louis Federal Reserve. Finally, the University of Michigan consumer sentiment survey has contracted by 5.5 points over the last year, signaling consumers’ willingness to consume has softened.

As noted above, in 2023 nominal GDP growth—which is essentially the combination of inflation (pricing) and real GDP growth (unit volume growth)—was about the same as the long-term average in the U.S. since 1970. This year, the low-flying “angels” are leading toward slower growth rates than the U.S. economy has witnessed over the last 50 years, on average.

Slower Growth Leading to Lower Interest Rates

Along with my “seeking of balance” mantra, a saying I harbor is “There are no solutions to problems, only trade-offs.” Such is the case with many issues in life, with economics being no exception to this broad rule. As economic growth slows, job creation slows, leading to a slowdown in final demand growth (Phillips curve), which brings down pricing pressures. I suggest this trade-off will continue for most of 2024 and into 2025. I continue to look for further weakening in the jobs market as the year progresses.

With the slower growth rate unfolding, bringing lower inflationary pressure with it, the Fed is signaling it will start to bring interest rates down this year. I have been suggesting that the rate decrease cycle may start in September, followed by one more rate decrease later this year. These moves, if they unfold, will bring the fed funds (overnight) interest rates down to a 4.75% to 5.00% range from today’s 5.37% level.

Goldilocks’ “Just Right” Playing Out in the Stock and Bond Markets?

It may be useful for investors to be aware that during previous years when the nominal GDP growth rate has been between 4.1% and 8.0%, the S&P 500 has generated an average return of 14.6%, well above the long-term average (54% of years over the last 62 years).1 I have classified these years when GDP growth hasn’t been “too hot” or “too cold” but “just right” as the Goldilocks years.

What of the other years when the Goldilocks environment was not at hand? Those 46% of years between 1960 and 2022, or years when nominal GDP growth was between 0% and 4.0%? Harkening back to the children’s fairy tale, years when growth was “too hot” or “too cold”? Well, the S&P 500 average return of those years was 6.5%, still positive but less than half the average return experienced during the Goldilocks years.2

What of bonds? How has the bond market performed during previous periods when the economic “porridge” was neither too hot nor too cold?

While the stock market seems to buy into the Goldilocks theme, the bond market has, so far this year, marched to a different drummer. However, if the Fed follows the thought that short rates will be coming down, I suggest longer rates may follow suit (to a lesser extent), which would bolster bond returns in the second half of 2024.

Angels Flying Close to the Ground – Closing Thoughts

The problem with an economy that is “flying close to the ground” is, of course, a shock. If we experience some kind of shock that shakes business and consumer confidence levels sufficiently, the distance between the economic “altitude,” or growth rate, and the ground is limited. I am keeping my eye closely glued to the labor market, which I think is key to maintaining positive overall real growth in the economy. At this time, the labor market looks good. Not great, but good.

Good enough to keep Goldilocks happy in that things seem not too “hot” or “cold,” but “just right.”

Source:

1,2New York University Stern School database

This commentary is provided for informational and educational purposes only. It is not intended to be personalized advice or a recommendation to buy or sell any security or engage in a particular investment or other strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Actual results or developments may differ materially from those projected. The information is deemed reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties. Any opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Investing involves risk and the potential to lose principal. Past performance does not guarantee future results. Please consult your financial professional before making any investment or financial decisions.

The indexes referenced herein are unmanaged and cannot be directly invested in. The S&P 500 Index is a market-cap weighted stock index constructed to track the share price performance of the top 500 large-cap U.S. equities.

Investment advisory services are offered through Investment Adviser Representatives (“IARs”) registered with Mariner Independent Advisor Network (“MIAN”) or Mariner Platform Solutions (“MPS”), each an SEC registered investment adviser. These IARs generally have their own business entities with trade names, logos, and websites that they use in marketing the services they provide through the Firm. Such business entities are generally owned by one or more IARs of the Firm. For additional information about MIAN or MPS, including fees and services, please contact MIAN/MPS or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Registration of an investment adviser does not imply a certain level of skill or training.

MIAN and MPS do not provide legal or tax advice.